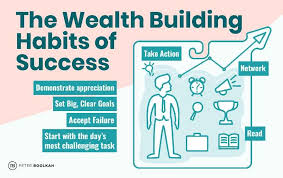

5 Essential Financial Habits for Building Long-Term Wealth

Achieving long-term wealth requires more than merely earning money; it entails cultivating sound financial habits for sustained success and independence. By consistently engaging in budgeting, saving, strategic investing, debt management, and ongoing financial education, individuals can secure their financial future.

Prioritize Consistent Saving

Wealth accumulation begins with consistent saving, establishing a robust foundation for financial growth and stability. Cultivate the disciplined practice of regularly allocating a portion of your income to savings, irrespective of the amount. Over time, these savings benefit from compound interest, building a substantial financial reserve for emergencies or future investments. Employ automated transfers to dedicated savings accounts or retirement funds to ensure regular contributions, minimize spending temptations, and encourage healthier financial habits. This approach provides peace of mind, knowing you are progressively working towards a secure financial future.

Invest Wisely and Diversify

Prudent investing is fundamental to sustainable financial growth. Consider a diverse range of investment options, including stocks, bonds, real estate, and emerging asset classes such as cryptocurrencies and mutual funds, to construct a diversified portfolio. Diversification mitigates risks and fosters a more stable financial future. Consulting experienced financial professionals and staying informed about market trends can significantly enhance investment strategies, leading to long-term success and prosperity. Warren Buffett, one of the most accomplished investors, advises investing in what you understand and maintaining a diversified portfolio to manage risks. Buffett’s methodology emphasizes assessing the long-term potential of investments rather than making impulsive decisions driven by market trends.

Furthermore, it is crucial to understand the power of patience when it comes to wealth-building. Financial success rarely happens overnight. By embracing discipline and maintaining a long-term perspective, individuals can weather market fluctuations and other challenges. Consistency, adaptability, and a willingness to learn from setbacks will enable you to stay on course and build lasting wealth for generations to come.

Set Clear Financial Goals

Clear and well-defined financial goals are essential for providing direction and motivation. Whether aiming to purchase a dream home, finance your children’s education, or ensure a comfortable retirement, specific and measurable objectives guide informed decision-making and strategic planning. Goal setting should be accompanied by actionable plans with realistic timelines, financial benchmarks, and regular progress assessments. This comprehensive strategy enables individuals to make necessary adjustments and remain focused on achieving their financial aspirations. By continually evaluating and refining these plans, you can ensure long-term financial stability and success.

Maintain a Budget

Budgeting is a vital tool for effective financial management. By meticulously monitoring spending and identifying areas for improvement, you can align your financial activities with your long-term goals. A well-maintained budget ensures that essential expenses are covered while allowing for savings and strategic investments, crucial for future financial security and prosperity. Advanced budgeting applications and sophisticated software can streamline this process, offering valuable insights and analytics to guide informed financial decisions for sustainable stability.

Continuously Educate Oneself

Financial literacy is an ongoing journey of learning and discovery. Staying informed about financial matters empowers individuals to make sound decisions in both personal and professional contexts. This involves mastering tax laws, evaluating investment opportunities, and staying current with economic trends. Participating in online courses, attending seminars, and reading reputable publications can greatly enhance financial knowledge and decision-making skills. By dedicating time to expanding financial literacy, individuals can achieve greater financial stability and long-term success.

Dennis Domazet achieves financial success through consistent saving, strategic investing, and a commitment to continuous learning. As a skilled tax accountant and the financial consultant, Dennis Domazet Toronto exemplifies how cultivating good financial habits—such as saving, investing wisely, setting goals, budgeting effectively, and learning continuously—supports long-term wealth and financial security.